Education and learning is what survives when what has been discovered has been neglected. – B. F. Skinner

Zovio Inc. (NASDAQ:ZVO) is an training technology company that functions specifically with educational institutions and organizations to build personalized understanding remedies. Zovio specializes in acquiring platforms that leverage information analytics to streamline curated content shipping to college students.

Zovio was started off in San Diego in 2014 beneath its initial identify, Bridgepoint Training. The company has a sector cap of about $132M, noticeably more compact than some of its competitors in the education and learning technology house, like Strategic Schooling Inc. (NASDAQ:STRA) ($2.3B) or Grand Canyon Education and learning Inc. ($814M) (NASDAQ:LOPE).

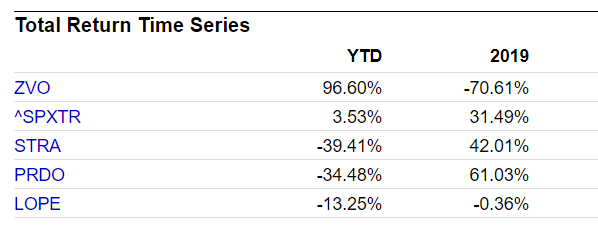

Contrary to its friends, Zovio has relished a in the vicinity of doubling of its inventory price tag so considerably this yr. From just in excess of $2 for each share at the commencing of 2020, ZVO is now trading previously mentioned $4. The appreciation in price tag, on the other hand, came following a dismal 2019 efficiency for the inventory.

ZVO has carried out significantly superior in 2020 as opposed to the total sector and similar names in the Schooling and Training Expert services Marketplace. – Source: YCharts

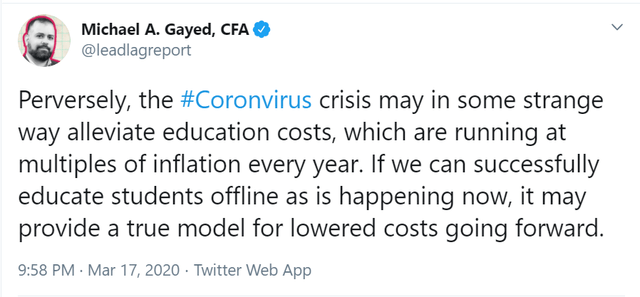

With continued disruptions to schooling introduced on by the pandemic, remote learning has taken heart phase in the latest months. As talked over in The Lead-Lag Report’s most modern World Watch, even though COVID-19 limits have softened in some regions, they are concurrently reemerging in other individuals, indicating further more protracted isolation actions. In this environment, Zovio is nicely geared up to serve any rising urge for food for remote instruction.

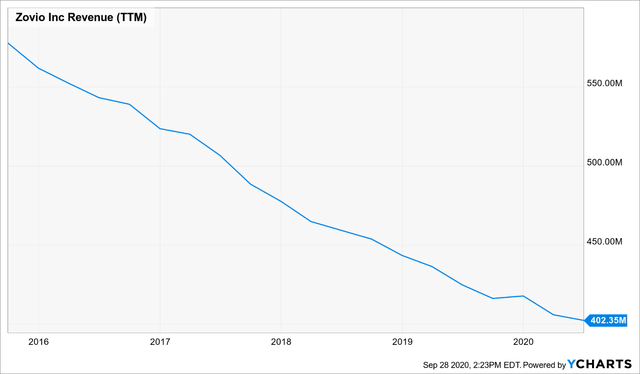

At the fundamental degree, ZVO reveals some troubling indicators. Earnings and earnings in current many years have unsuccessful to beat earlier calendar year success, top to a worrying downward trend.

2020 saw a continuation of reducing profits.

On the other hand, specific basic metrics provide factors for optimism. ZVO savored a recent ratio of 1.364 for the period ending June 30, 2020. Any price over one indicates the firm has been equipped to go over its existing liabilities working with its latest belongings. Zovio also enjoys a modest personal debt to fairness ratio of only .025 and has created more than $47M in annual hard cash stream each yr, on ordinary, for the previous ten years.

Zovio prides by itself on delivering curated, customized instruction for learners. Given the trajectory of education and learning, desire for far more distant, custom made finding out will probably only enhance. Fullstack Academy (coding bootcamps) and TutorMe (comprehensive online support matching college students with tutors) are two Zovio manufacturers in specific that I count on will mature in popularity, presented the recent surroundings.

Impacts from the pandemic are also impacting the way workers of providers entire continuing training. COVID-19 disruptions will only provide to even further drive corporations to utilize remote studying for their staff members, of which Zovio is a facilitator. Instructional institutions, much too, ever more threatened with decrease actual physical enrollment, will look to organizations like Zovio to aid them pivot and continue on to sustain and improve their student inhabitants.

Remote learning is even now extremely considerably in its infancy, but COVID-19 problems are swiftly prompting development in this sector. Despite the fact that ZVO displays some worrying indicators at the elementary level, it operates in this swiftly increasing space and enjoys an existing network and set up brand. Offered this reality, further more appreciation in Zovio’s share selling price in the coming months may well not be surprising.

*Like this short article? Never overlook to strike the Abide by button previously mentioned!

Subscribers informed of soften-up March 31. Now what?

Subscribers informed of soften-up March 31. Now what?

At times, you might not understand your most important portfolio threats until finally it truly is as well late.

Which is why it is essential to shell out notice to the appropriate sector details, investigation, and insights on a each day basis. Getting a passive trader places you at needless chance. When you remain knowledgeable on critical alerts and indicators, you’ll consider management of your financial long term.

My award-successful marketplace study offers you anything you have to have to know each day, so you can be prepared to act when it matters most.

Click here to attain entry and try out the Guide-Lag Report No cost for 14 times.